Rate hikes are coming, but don’t fret. There are simple ways to make a profit from the foolishness of the Federal Reserve.

The fear of rate hikes has been hanging over the metal like the Sword of Damocles for the past the past two years, and it’s about to fall over the next month.

You see, the Federal Reserve is tasked with two things: controlling inflation and boosting employment.

As President Obama is proud to crow about, the unemployment rate as put out by the Bureau of Labor Statistics (BLS) has been falling for six years and is now at a rate not seen since 2008.

Data as of November 1 from the BLS:

You can argue about fake numbers, U6, and participation rate all you want, but it doesn’t matter. The chart above is the chart that the Fed watches. And the Fed will tell you that it has met its requirement on unemployment.

Inflation

The BLS also puts out inflation information in the form of the CPI. As you can tell by this 10-year chart, inflation is low and steady, though it is creeping higher over the past year.

Now, the Fed has said in the past that it would raise rates. If you remember, there were to be four rate hikes in 2016 — so far we’ve had one last December.

Needless to say, the credibility of the Fed is worth about as much as a political promise on Election Eve.

The next meeting of the FOMC will be held on December 13th and 14th.

And given the flatness of the market over the past few months, the market hasn’t yet priced in this looming rate hike.

I expect the Fed hikes rates in December — it is as close to certain as is possible.

If we assume that we do get the hike in December, it will almost certainly give the U.S. dollar a boost, which, in turn, will push gold down one last time.

Traditionally, gold and the dollar trade inversely. When gold goes up, the dollar goes down. But it doesn’t have to happen that way.

And in fact, often when rate hikes are occurring, gold and the dollar will both go up.

Take a look at this U.S. dollar index. The dollar has been riding an uptrend since May. It hit resistance at 99 and is having a hard time breaking above it.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to is join our Energy and Capital investment community and sign up for the daily newsletter below.

Dollar Index:

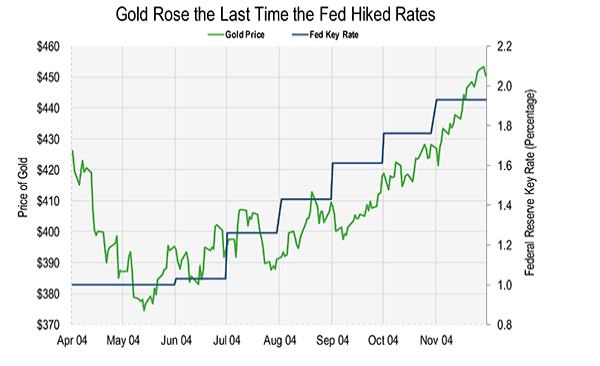

That said, history tells us that over the last four rate hikes, the price of gold has gone up.

That is to say, it sells off into a rate hike and then jumps afterwards.

Investors note the inverse relationship between gold and the dollar and sell gold going into the rate hike announcement. They buy gold after the announcement.

The last time the Fed was raising rates was back in 2004. Check out this chart:

Here is some more data put out by the Fed and composed by BullionVault:

You will notice that the one-year average gain is higher than the one-year average gain after a rate cut! That is the exact opposite of conventional wisdom.

Why does this happen? The obvious answer is inflation. When the Federal Reserve is hiking rates — usually too late — it is because it fears inflation is coming down the pipe. As you can see from the first chart, inflation has been rising since late 2015.

So when the Fed fears inflation, there is often good reason. And as we all know from the 1970s, gold does well in inflationary environments.

Now, nobody is talking about inflation anymore. The inflation guys have been relegated to the tinfoil-hat-wearing, flat-earth, Ron Paul voters and the other assorted lunatic fringe of economics.

They were beaten to death after vast trillions of money printing post-2008 produced deflation in spades.

But as we all know, the market always reverts to the mean, and inflation will have its day. And just as the top comes when everyone is bullish and the bottom happens right after the last guy jumps from the penthouse tower with his suit pockets stuffed with stock certificates, so too does inflation show up when no one is looking.

Now is the time to start buying gold. It will be your last, best time to buy the dip. Find out more: Read the “Great Gold Hoax,” and become one of us.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.